Introduction

Travel is an experience—an opportunity for growth, connection, education, and transformation. Navigating the world of car rentals can be tricky, especially when it comes to understanding the ins and outs of rental car insurance. With various options and complex jargon, it’s easy to end up paying more than necessary. But as a savvy traveller, you can avoid common pitfalls and save money by being informed and making smarter choices. This guide will help you separate fact from fiction and provide tips on how to manage rental car insurance without breaking the bank.

The Truth About Rental Car Insurance

Breaking Down Common Myths

Many travellers mistakenly believe that rental car insurance is a must-have, irrespective of their circumstances. However, this isn’t always the case. One prevalent myth is that you automatically need rental insurance to drive legally, which is typically not true. Your existing auto insurance often extends to cover rentals.

Another myth is that rental companies’ insurance provides complete coverage, shielding you from all possible damage costs. In reality, their plans often only cover certain aspects, leaving gaps. It helps to remember that insurance opt-ins at the rental counter usually come with a hefty markup, often making them a costlier option compared to alternatives. According to a recent study by CarInsuRent, 73% of travellers overpay on average $18.42/day for car rental insurance when purchasing coverage at airport counters, with the average overpayment reaching an astounding 247% compared to equivalent third-party coverage.

Understanding these myths can save you from unnecessary expenses and make your travels more affordable and stress-free.

Hidden Costs You Didn’t Know About

Rental car insurance is often laden with hidden costs that can quietly inflate your overall expense. One common unexpected fee is the “loss of use” charge, which rental companies impose for the potential income lost while a vehicle is being repaired after damage. This can significantly increase your out-of-pocket costs if you’re not covered for it.

Another surprising cost is the additional administrative fees and taxes that accompany the insurance. These can add up quickly, far exceeding a budget-conscious traveller’s expectations. It’s also worth noting that “collision damage waivers” (CDWs) provided by rental companies are not technically insurance, despite being presented as such. Instead, they simply waive the company’s right to make you pay for certain types of damages, sometimes excluding expenses like tire or windshield repair.

To avoid such unexpected charges, it’s crucial to ask pointed questions at the rental counter and carefully read the fine print.

Alternatives to Save Money

Explore Third-Party Insurance Options

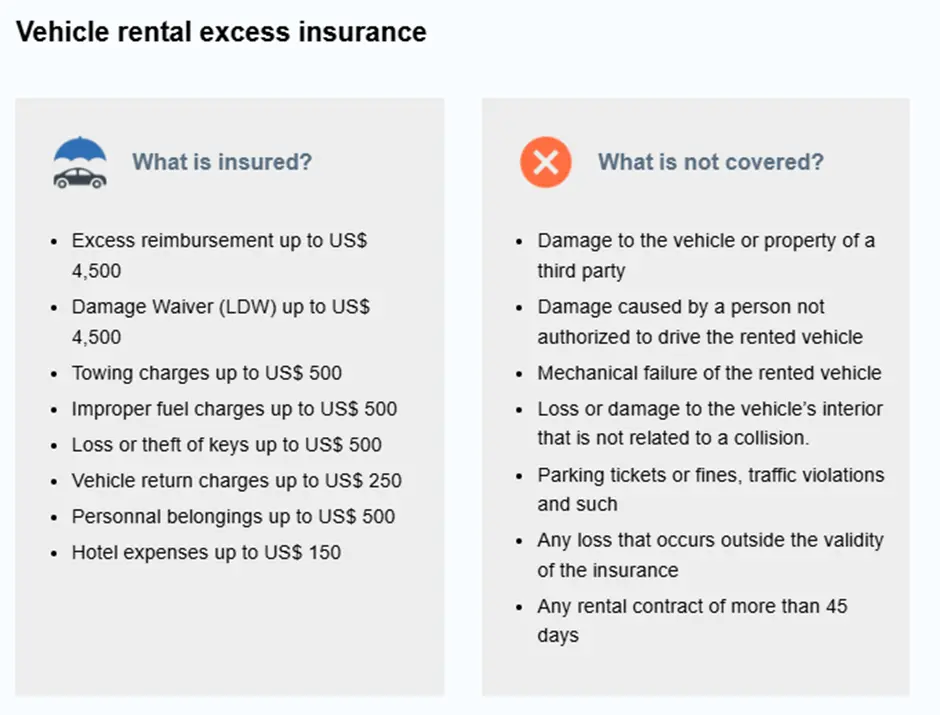

Considering third-party insurance options can offer a cost-effective and comprehensive alternative to rental company coverage. External providers, such as CarInsuRent, typically offer lower rates and cover areas that rental companies might exclude, such as personal belongings.

Third-party insurers are known for more flexible coverage, allowing you to tailor a plan to fit your specific travel needs. Additionally, they often include coverage for international travel, which can be particularly beneficial for globetrotters. Compare different providers to ensure you’re getting the best deal; some even offer endorsements or reviews from other travellers.

For savvy travellers looking to maximize savings without compromising on protection, researching and purchasing third-party insurance well in advance could be a game-changer.

Use Your Existing Auto Insurance

Leveraging your existing auto insurance policy is a smart way to save on rental car insurance without sacrificing coverage. Most personal auto insurance policies extend coverage to rental vehicles, particularly if you’re renting domestically. This means your liability, collision, and comprehensive coverage likely apply while driving a rental car.

To confidently use your auto insurance, it’s essential to understand the details of your policy. Contact your provider to confirm whether your coverage extends to rentals, and inquire about any limitations or additional coverage for specific situations, like business trips or international rentals.

Using your existing auto insurance is not only more convenient but also a budget-friendly option. However, ensure that your policy’s deductible is manageable, as you’ll be responsible for it if any claims arise during your rental period.

Leverage Credit Card Benefits

Credit cards often come with built-in rental car insurance benefits that can significantly cut costs. Many major credit cards offer secondary coverage for rental cars, meaning they can cover what your personal auto policy doesn’t, including deductibles or loss-of-use fees. Some premium cards even provide primary coverage, eliminating the need to involve your auto insurance at all.

To make the most of these benefits, you’ll need to know the specifics of your card’s coverage. This includes understanding what types of vehicles are covered, the maximum coverage limit, and any geographical limitations. Contact your credit card provider for a detailed breakdown of the insurance benefits associated with your card.

Leverage these benefits by reserving your rental car with the credit card offering the best coverage. This not only saves money but also streamlines your rental experience. However, always read the terms and conditions carefully to avoid any unpleasant surprises.

When Is Rental Car Insurance Necessary?

High-Risk Destinations and Scenarios

In certain destinations and scenarios, opting for rental car insurance might be a wise decision. High-risk areas, known for frequent vehicle thefts or accidents, often make additional coverage worthwhile. For instance, urban centers with dense traffic or locations with less reliable road conditions can present added risks.

When traveling internationally, especially in countries where road rules differ significantly, supplemental coverage can offer peace of mind. Specific activities, such as off-roading or using the rental for a lengthy road trip, also increase the likelihood of incidents, making extra protection beneficial.

Assessing your itinerary and evaluating the potential risks can guide whether additional insurance is necessary, helping you balance costs while ensuring adequate protection.

No Personal Coverage? No Problem!

If you find yourself without personal auto insurance, there’s no need to worry. Several alternative options can provide the coverage you need for renting a car. Rental companies offer a basic set of plans that include liability and collision damage waivers, providing immediate coverage directly at the counter. While usually more expensive, they ensure you’re driving away with protection in place.

Third-party insurance providers serve as another viable option. CarInsuRent, for example, offer competitively priced plans and often encompass extensive coverage areas. Additionally, travel insurance policies can include rental car damage protection, especially useful if you’re already purchasing coverage for other aspects of your trip.

Exploring these alternatives will ensure you have the coverage you need, even without personal auto insurance, allowing you to travel with confidence and economy.

Expert Tips for Cutting Rental Costs

Book Early and Smart

Securing your rental car early is one of the most effective strategies for saving money and ensuring convenience. Booking in advance typically offers the benefit of lower rates and a wider selection of vehicles. You lock in your rate early, protecting you from potential price hikes as demand increases closer to your travel dates.

Smart booking also involves using comparison websites to check various rental outlets, enabling you to find the best deals. Look for free cancellation options, which allow you to rebook if prices drop.

Additionally, consider off-peak times for picking up and dropping off your vehicle, as they often come with lower costs. A bit of strategic planning can greatly reduce your expenses and make your rental experience more seamless.

Beware of Airport Rentals

Opting for airport car rentals may seem convenient, but it often comes with hidden premium costs. These rental counters typically charge more due to additional fees and taxes imposed by the airport authorities. It’s not uncommon for airport rentals to be up to 30% more expensive than their offsite counterparts.

To minimize costs, consider booking a rental from a location near the airport instead. Many companies offer complimentary or low-cost shuttles to their off-airport sites, allowing you to bypass the hefty surcharges. Planning ahead can help you identify the nearest affordable options.

By choosing a location outside the airport, you not only save money but also potentially enjoy a wider vehicle selection. This option is ideal for those who prioritize budget and flexibility over immediate convenience.

Utilize Membership Discounts

Taking advantage of membership discounts can lead to significant savings on your next car rental. Many organizations, including AAA, AARP, and frequent flyer programs, offer exclusive discounts or benefits with certain rental companies. These perks can include reduced rates, free upgrades, or even no-cost additional drivers.

If you’re a member of any industry-specific professional organizations, check for potential partnerships with rental agencies. Sometimes, these affiliations provide special rates that aren’t widely advertised.

To access these discounts, always mention your membership when booking and have any necessary documentation on hand at pick-up. Identifying and leveraging these discounts helps you optimize your rental expenses, making your travel experience more affordable and enjoyable.

Also Read-Explore Sports Betting Systems – Big Winning Opportunities for Sports Lovers